How to Get Money (Including $10k immediately) for Your Business

I help small businesses figure out their shit. Usually how to sell more stuff, get more website visitors, or determine what to spend on pay per click ads. However, Coronavirus has turned the world up-side-down. I want to help small businesses pivot to survive during this pandemic. However, most of them don’t have the time or the money to figure out payroll, let alone how to dramatically change their business model to endure in this new world. The most pressing issue for most is cash, as without it, there will be no time to pivot and millions of good businesses will surely die.

When I saw the $350 billion CARES Act was going to make it through the House and Senate, I became curious how it would actually roll out. Who would be eligible to apply? What information would be required? Where do we apply? None of this was clear, and a lot of us were frantically scouring the SBA.gov website, calling our bankers, and trying to figure out which form to fill out to get our names in the hat for this pile of life-giving money.

In this post I’m going to cover the following:

How the CARES Act can help your small business

What the Paycheck Protection Program (PPP) & Economic Injury Disaster Loan (EIDL) are and how they differ

Who is eligible

How to apply

My own experience applying for both of these programs

How the CARES Act Can Help Your Small Business

The CARES Act, signed on Friday, March 27th 2020, allocates $349 billion to lending programs to help small businesses, including the self-employed, independent contractors, or “gig economy” workers. With over 30 million small businesses in the US, there will be a lot of companies looking for a piece of these funds. Not only has a new program been created (Paycheck Protection Program), but existing programs, such as the Economic Injury Disaster Loan (EIDL), have had their application processes dramatically streamlined, and personal guarantees either removed or reduced. In addition, the approval process for both programs is supposed to be expedited.

Paycheck Protection Program

The first new program is the Paycheck Protection Program (PPP), which provides 100% federally guaranteed loans to small businesses. Some or all of the loan can be forgiven, if the expenses meet certain requirements and are approved.

How Much Can I get?

The CARES Act allows for loans up to $10M, but this is based on the formula of 2.5x your average monthly payroll in the year prior to the loan date. Compensating employees over $100,000 isn’t covered by the loan. Any portion that isn’t forgiven will carry forward with a maximum maturity of 10 years and 4% interest, with the option to defer payments for up to one year.

Included in the calculation to determine loan amount:

Salary, commission, tips, vacation pay, sick/family leave

Severance pay, health insurance, group health benefits, retirement pay, state/local tax assessed on employees

Excluded from the calculation:

Compensation of an employee in excess of $100,000

Qualified sick leave wages for which credit is allowed under the Families First Coronavirus Response Act

What can be forgiven?

Some of all of the loan can be forgiven if staffing and wage levels are maintained. There is a remedy for wage or staffing reductions that took place between February 15, 2020 and April 26th, 2020, as long as released employees are re-hired and salary reductions are reversed.

If the aforementioned staffing and wage restrictions are meant, payroll expenses, employee salaries, mortgage interest, rent & utilities, and interest on debt incurred before 2/15/20 can all be forgiven.

How do I apply for the Paycheck protection program (ppp)?

To apply for the Paycheck Protection Program, you will need to go through an approved SBA 7(A) lender. Many national and regional banks provide SBA 7(A) loans, but aren’t yet ready to provide the PPP. I recommend reaching out to your banker for up-to-date information on this. As soon as I know more I’ll update this section.

Economic Injury Disaster Loan (EIDL)

The Economic Injury Disaster Loan (EIDL) existed prior to the CARES Act, however, the application process has been dramatically streamlined through a simple online form that requires very little business information. In addition, it is offering a $10,000 immediate advance to the bank account you enter into the form. You don’t have to pay this back. Supposedly the SBA will be delivering these advances within 3 days of application. None of the loan itself can be forgiven, but it can be used for a wider range of expenses than the Paycheck Protection Program.

How much can I get?

Up to $2 million for use paying fixed debts, payroll, accounts payable, or other bills that can’t be paid because of the disaster’s impact upon the business. The interest rate for small businesses is 3.75%, and non-profits is 2.75%. While long-term repayments of up to 30 years are available, payment terms are determined on a case-by-case basis, based upon each borrow’s ability to repay. You can receive the $10,000 immediate advance, regardless of whether you are actually approved for the EIDL!

How do I apply for the Economic injury disaster loan (EIDL)?

In the last 24 hours the application process has been dramatically simplified, changing from a complicated assortment of PDF forms, to a very quick online application. For my sole proprietor (single member LLC) business, it took me less than 10 minutes. In addition, the final step will ask whether you’d like a $10,000 immediate advance, as well as your bank account routing information.

You can find the application here: https://covid19relief.sba.gov/

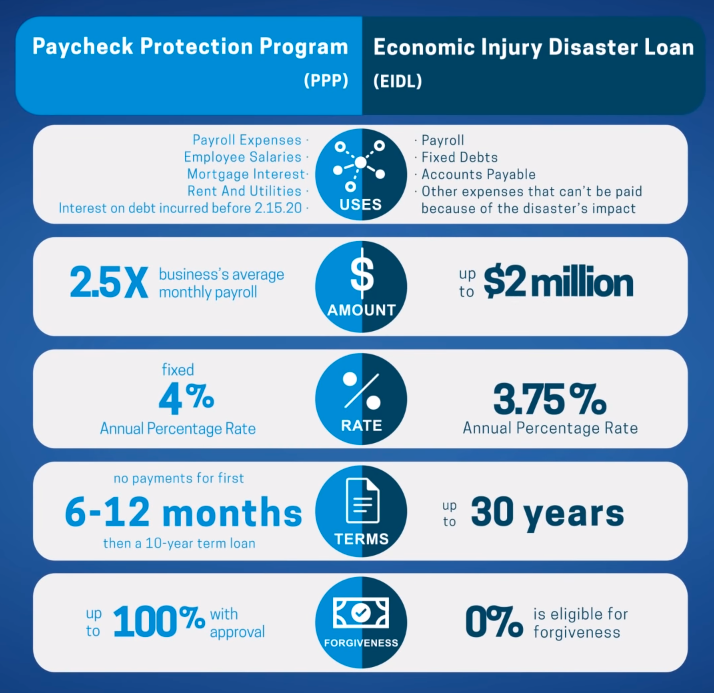

What are the differences between the PPP and the EIDL?

A comparison of the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL)

Image courtesy of Live Oak Bank

Eligibility

For profit and non-profit businesses with 500 or fewer employees during the “covered period” of February 15th-June 30, 2020

Individuals who operate sole proprietorships, LLCs, or as independent contractors

The CARES Act recommends that the SBA issue guidance to lenders to prioritize small businesses and entities in under-served and rural markets, as well as those owned or operated by veterans, members of the military, women, or socially and economically disadvantages individuals and businesses in operation less than 2 years

Can I Apply for Both the PPP and EIDL?

You can apply for both loans, but there can be no “duplication of use of funds.”

My Experience Applying for Assistance for My Consulting Business

As I frantically researched all of this I, of course, was wondering how this could apply to my own small business. As a single member LLC, I figured most of the funding would be focused on keeping businesses that employ a lot of people on payroll. However, I was glad to see that sole proprietors and independent contractors like myself are getting something out of this, too.

I spent much of the past week refreshing the SBA.gov website, looking for a streamlined form of some sort. Lo and behold, before I went to bed I noticed the EIDL form was online and VERY simple to fill out, at least for a sole proprietor.

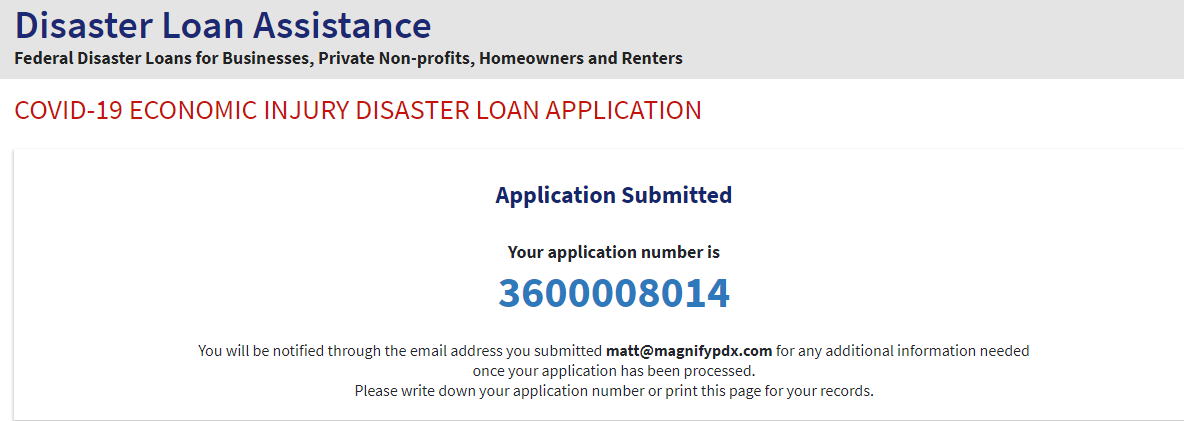

After less than 10 minutes filling out the form, I was provided the following:

I’ve been in frequent communication with a VP of Business Banking at Chase Bank, who has kept me abreast of the latest news for the other assistance (PPP). Here’s the latest e-mail from him that came in a few minutes ago, much of what was covered above:

We are awaiting more guidance from the U.S. Small Business Administration. Right now, we’re unable to take applications until we know more from the SBA. I will continue to provide updates as they come, but below is the most recent information I have to provide at this time. Call volumes are extremely high and wait times are longer than normal. We’re encouraging the use of our Chase for Business online platform for your daily bank transaction needs as well as our Covid-19 Business Update site for additional information.

We will continue to update chase.com throughout the week. One thing business owners can do in advance:

· Start gathering information about their average monthly payroll, which you will need for the application.

Who’s eligible?

All Businesses that have 500 or fewer employees (including sole proprietors and 501 (c) (3) organizations; but not government entities), were in business on or before February 15, 2020, and have suffered economic hardship as a result of the coronavirus pandemic.

What are Chase’s requirements to apply?

Chase applicants must have been a Chase business checking account customer as of February 15, 2020, and be able to log into Chase Business Online. The application will only be online. Clients will not be able to apply through their BRM, or by calling us.

What documents will customers need?

We’re not yet clear on what documents customers may need. For now, business owners should gather key financial documents – especially around payroll – so they are ready to apply.

What is the interest rate and term?

The legislation calls for a maximum interest rate of 4% for a term of not more than 10 years.

How will loan amounts be determined?

The maximum loan amount is 2.5 times the borrower’s average monthly payroll costs up to a maximum of $10M, whichever is lower. Any employee of the borrower who has an annual salary in excess of $100,000 must be excluded from the calculation. Monthly payroll should be calculated using average monthly payroll for prior year (or first two months of 2020 if business did not exist before 2020). As an example, a customer with an average monthly payroll of $10,000 might be approved for a $25,000 loan. Borrowers should consult their own legal, financial and tax advisors.

How is “payroll costs” defined?

Payroll costs are generally defined by the legislation as the monthly amount the business owner is paying his/her employees. It includes payroll tax, healthcare, retirement, etc.

Will payments be deferred?

Yes, payments will be deferred for a minimum of 6 months, per the legislation.

Can customers have a portion of the loan forgiven?

Yes. Customers may be eligible to have the loan principal forgiven if they use the funds for the approved purposes under the legislation and maintain the average size of their full-time workforce throughout the first 60 days of the loan term. In this case, they will only need to pay back the interest accrued. More information will be provided during the loan application process.

Is there a limit to the Program?

Yes, the Program is first come first serve, and the SBA has currently appropriated $349 billion for the program. We anticipate a high volume of loan requests. This is why it is imperative for business owners to be prepared when the Program becomes available.